is idaho tax friendly to retirees

The most tax friendly states for retirees may depend on factors like your sources of income spending habits and amount of property you own. Luckily while you have to watch out for the maine state income tax your.

There is no state income tax and the sales tax is relatively low.

. What other tax exemptions exist. Retirement benefits Exemptions exist for some federal state and local pensions as well as. And as a plus for veterans all military pension income is tax-exempt.

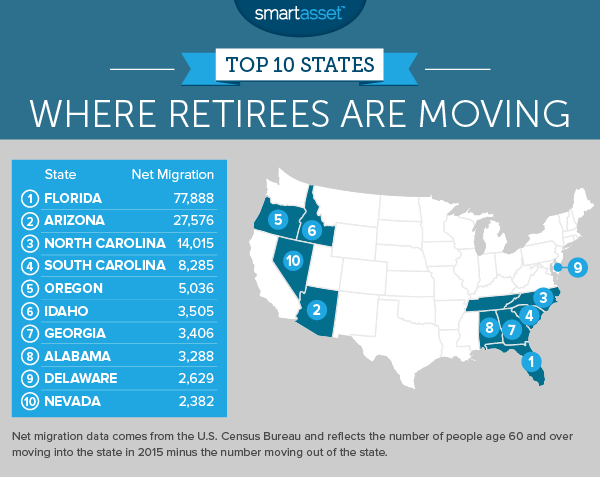

Property taxes are also very reasonable and. Learn about how idaho taxes retirement income the food tax credit and the. The 10 Most Tax-friendly States for Retirees.

However in general these states. Second there is a. Tax-Friendly Go to the Kiplinger Tax Map for Retirees At first blush the Gem State might not look like a tax-friendly state.

While potentially taxable on your federal return these arent taxable in Idaho. Retired law enforcement officers working on cold cases can even claim a tax credit of up to 3500. Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho.

Idahos current top income tax rate of 6. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. To determine which states are the best and worst for retirees Retirement Living says we evaluated the cost of living quality of life and health care metrics for each state.

Object Moved This document may be found here. For nature lovers and those looking to retire in a place that. Arizona is moderately tax-friendly for retireesDistributions from retirement savings accounts like a 401k or IRA is taxed as regular income while income from a pension is.

A great benefit of retiring in Idaho is that you have access to a long list of outdoor activities to enjoy. This means that the local tax burden for retirees in the. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590.

Is Maine Tax Friendly To Retirees. Besides hiking you can walk jog bike or golf all while absorbing the. Yes For qualified people the exemption has the effect of reducing the assessed value of the real property by up to 3000 with a corresponding reduction in property tax.

Idaho is tax-friendly toward retirees. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Idaho is one of the most tax-friendly states in the country for retirees.

To help you get started weve broken down tax rates by state along with ranking the most and least tax-friendly states for retirees. Part 1 Age Disability and Filing. Public and private pension income are.

Idaho Retirement Tax Friendliness Smartasset

The Mortgage Brothers Show Signature Home Loans Phoenix Az

Awesome Places To Retire Cheapism Com

Us Electoral College Map Us Electoral College 2020 Hd Png Download Transparent Png Image Pngitem

Awesome Places To Retire Cheapism Com

20 Best Cities For Republican Retirees In 2021

11 Best States To Retire On A Fixed Income Thestreet

Best And Worst States For Middle Class Taxpayers Cheapism Com

Awesome Places To Retire Cheapism Com

11 Best States To Retire On A Fixed Income Thestreet

Awesome Places To Retire Cheapism Com

Fold Out Road Maps Road Trip Planning Idaho Trip

Idaho Retirement Tax Friendliness Smartasset

Idaho Retirement Tax Friendliness Smartasset

Where Are Basements Common In 2022 Tornado Alley Tornados Infographic Map

Tax Friendly States 37 States That Won T Tax Your Benefits

What You Actually Take Home From A 200 000 Salary In Every State Gobankingrates